Analysing the Surge in Regulatory Publications on the theme of Life & Pensions from 2020 to H1 2023

Published on 6th October 2023THE GLOBAL LIFE AND PENSIONS SECTOR HAS BEEN NAVIGATING AN ERA OF RAPID REGULATORY CHANGES AND UNPRECEDENTED GROWTH IN REGULATORY PUBLICATIONS

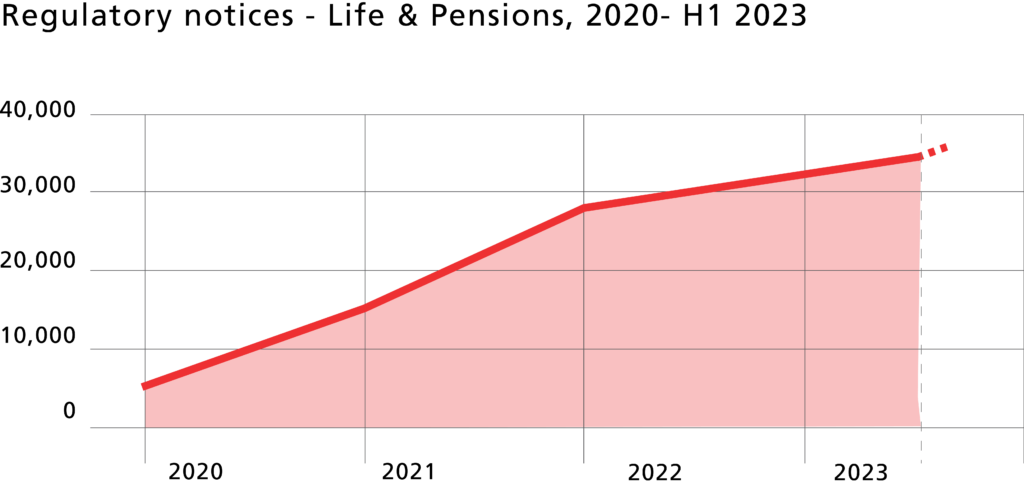

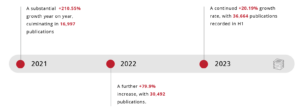

From 2020 to the first half of 2023, this industry has witnessed a remarkable transformation in terms of regulation with an increase in regulatory publications of 669%.

This surge can be attributed to a combination of factors, including pandemic responses, technological advancements, demographic shifts, ESG considerations, and increased globalisation.

EXPONENTIAL GROWTH IN REGULATORY PUBLICATIONS

Over the past three and a half years, there has been an explosive increase in the number of regulatory publications in the life and pensions sector. These statistics (shown below) underscore the accelerating pace at which regulatory changes are impacting the sector, and are ever-increasing with recent regulation such as Consumer Duty.

FACTORS DRIVING REGULATORY EXPANSION

Several key factors have contributed to this unprecedented growth in regulatory publications:

1. Pandemic Response (2020-2021): The COVID-19 pandemic prompted immediate regulatory adjustments to address the challenges faced by the life and pensions industry. Authorities worldwide introduced measures to ensure the financial stability of the sector and protect policyholders.

2. Technological Advancements: The sector’s increasing reliance on technology, including digital platforms, artificial intelligence, and data analytics, necessitated regulatory updates to manage associated risks and ensure customer data security.

3. Demographic Shifts: As populations age and pension planning becomes more critical, regulators have been actively working to enhance protections for pensioners and ensure the long-term sustainability of pension schemes.

4. Environmental, Social, and Governance (ESG) Focus: The growing emphasis on ESG principles and responsible investing led to regulatory frameworks aimed at aligning the sector with sustainability goals and ethical investment practices.

5. Globalisation: With the globalisation of financial markets, cross-border regulatory cooperation has intensified, resulting in the need for harmonised standards and guidelines.

IMPACT ON INDUSTRY PLAYER

The surge in regulatory publications has had profound implications for industry stakeholders:

1. Regulatory Compliance Challenges: Insurers, pension funds, and related entities have faced escalating compliance demands, necessitating substantial investments in compliance departments and systems to meet evolving requirements.

2. Innovation and Adaptation: To remain competitive, companies have had to innovate rapidly, creating new products and services in response to regulatory changes, with a strong focus on customer-centric offerings.

3. Regulatory Risk Management: Heightened regulatory scrutiny has emphasised the importance of robust regulatory risk management practices, and the need to enhance management information (MI) systems so that they are up to the task.

4. Global Expansion: Companies seeking growth opportunities have been required to navigate complex regulatory landscapes in various countries, necessitating a deep understanding of local and international regulations.

If you’d like to know more about Corlytics and our solutions for Insurance/ Reinsurance firms please get in touch with us